Table of Content

- Publication 523 - Main Contents

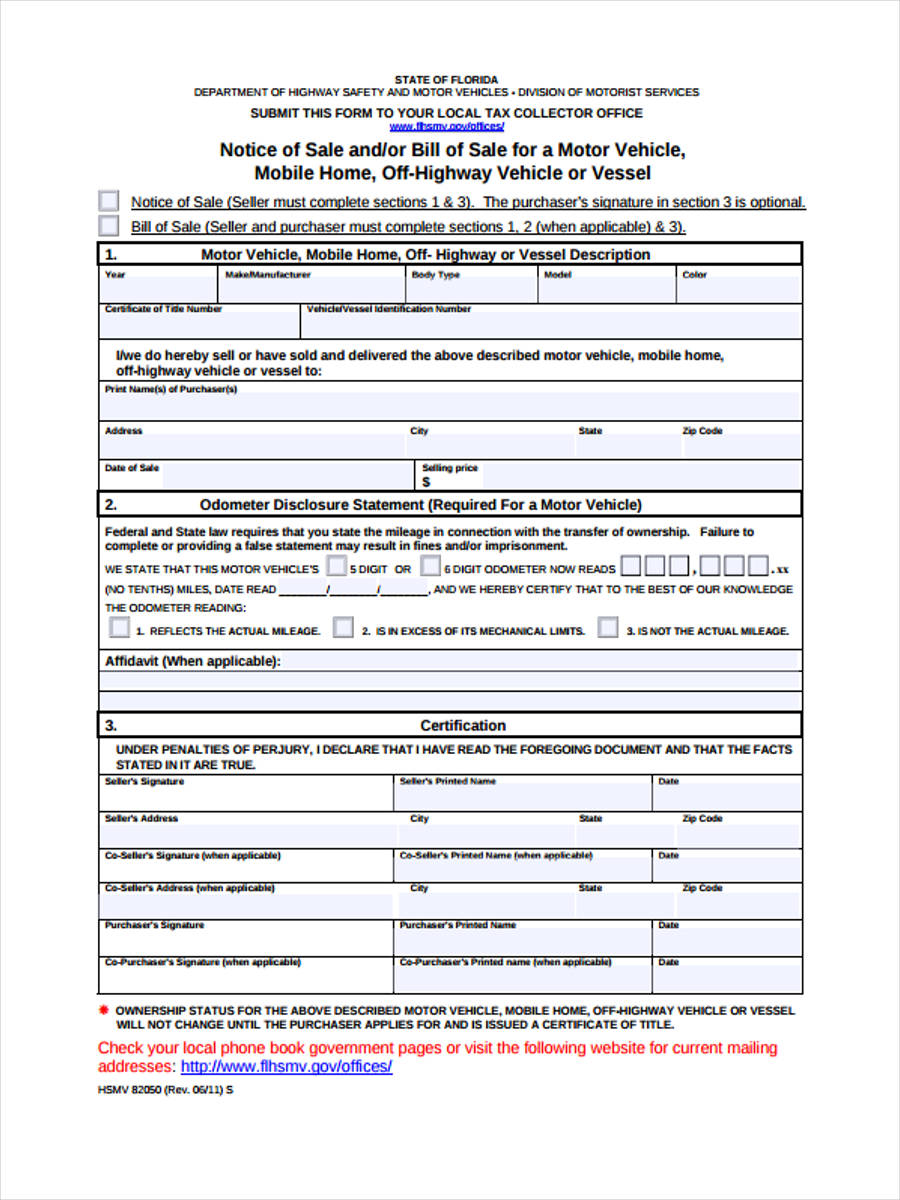

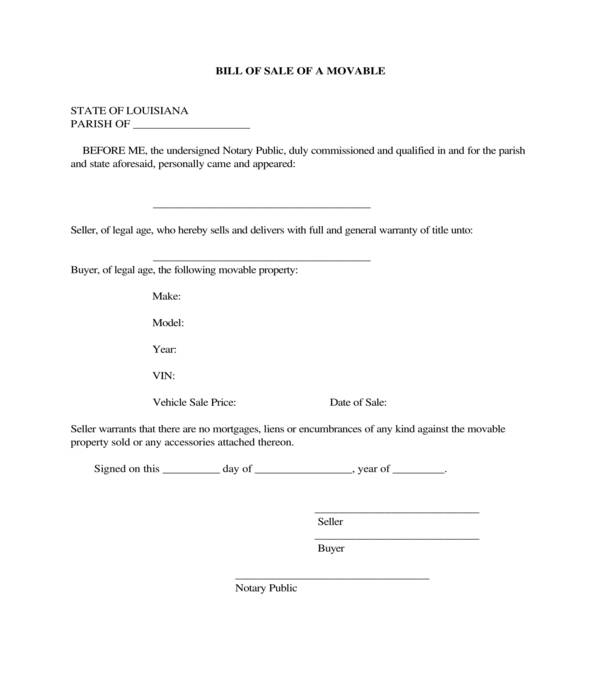

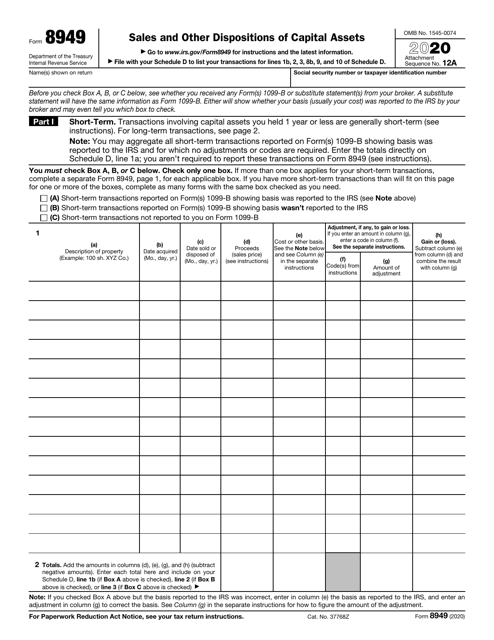

- How do I report the sale of my house on Form 8949?

- Reporting the Sale of a Foreign Home

- Non-qualified use modification of the home sale exclusion

- What is the 1099-S Certificate Exemption Form?

- Do I have to report the home sale on my return?

- Qualifying for the Exclusion

- Forms & Instructions

Taxpayers who file Form 1120-S or Form 1065 and other qualified entities should see Special provision for certain corporations, partnerships, securities dealers, and other qualified entities, later. You don't need to complete and file an entire copy of Form if you can check a single box to describe all your transactions. In that case, complete and file either Part I or II and check the box that describes the transactions. Otherwise, complete a separate Part I or II for each category of your transactions, as described above. A nonbusiness bad debt must be treated as a short-term capital loss. 550 for what qualifies as a nonbusiness bad debt and how to enter it on Part I of Form 8949.

Report the deferral of the eligible gain on its own row of Form 8949 in Part I with box C checked or Part II with box F checked . If you made multiple investments in different QOFs or in the same QOF on different dates, use a separate row for each investment. If you invested eligible gains of the same character on the same date into the same QOF, you can group those investments on the same row. In column , enter only the EIN of the QOF into which you invested. In column , enter the date you invested in the QOF. Enter code “Z” in column and the amount of the deferred gain as a negative number in column .

Publication 523 - Main Contents

You may have to pay this recapture tax even if you can exclude your gain from income under the rules discussed earlier; that exclusion doesn’t affect the recapture tax. If you sold furniture, drapes, lawn equipment, a washer/dryer, or other property that wasn’t a permanent part of your home, report the amount you received for the items as ordinary income. Report this amount on Schedule 1 , line 8z, or Schedule NEC (Form 1040-NR) if a nonresident alien. The selling price of your home doesn’t include amounts you received for personal property sold with your home. You wish to report your gain as a taxable gain even though some or all of it is eligible for exclusion.

Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D , Capital Gains and Losses. If you have no requirement to use Schedule D , report this amount on line 7 of Form 1040, U.S. Review the Instructions for Form 1040 (and Form 1040-SR) for more information. For the first row, in column , write “QOF INVESTMENT FROM FORM 4797.” Leave columns through blank. In column , report the amount of the QOF investment from Form 4797 as a positive number. For example, if ($75,000) was reported in column of Form 4797, report $75,000 in column of Form 8949.

How do I report the sale of my house on Form 8949?

Download the official IRS2Go app to your mobile device to check your refund status. Make a payment or view 5 years of payment history and any pending or scheduled payments. Go to IRS.gov/Account to securely access information about your federal tax account.

The gain you recognize will be the same character as the gain you deferred. Put the EIN of the QOF investment you are selling in column . Enter code "Y" in column , and in column enter the amount of previously deferred gain as a positive number.

Reporting the Sale of a Foreign Home

Exceptions to reporting each transaction on a separate row. The IRS partners with companies that offer Form 8949 software that can import trades from many brokerage firms and accounting software that can help you keep track of your adjusted basis in securities. Special reporting rules for corporations, partnerships, estates, and trusts in certain situations. See the instructions for the Schedule D you are filing for detailed information about other topics, including the following.

In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test. You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods. However, you must meet both tests during the 5-year period ending on the date of the sale. Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home.

Non-qualified use modification of the home sale exclusion

If you elect to amortize bond premium on a taxable bond, reduce the basis of the bond by any bond premium amortization allowed as either an offset to interest income or as a deduction for that bond. Reduce the basis of a tax-exempt bond by any bond premium amortization for that bond. The basis of property acquired by gift is generally the basis of the property in the hands of the donor.

A seller will also have to complete one 1096 transmittal form with all of your information. If the property was inherited and considered a personal capital asset, the same rules apply. The coalition estimates that as many as 40 million Americans will get one of these forms in January ahead of the filing deadline for 2022 taxes. Companies "may not have the information to know if they're dealing with a business transaction or personal transaction," said Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting. Real estate taxes – for both buyers and sellers – can seem complicated until you get the hang of it. If married, the sale or exchange of the entire residence is for $500,000 or less.

He meets the ownership and use tests because he owned and lived in the home for 3½ years during this test period. The Eligibility Test determines whether you are eligible for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly). You may take the exclusion, whether maximum or partial, only on the sale of a home that is your principal residence, meaning your main home. An individual has only one main home at a time.

DON’T follow the instructions at the end of line 7, under Worksheet 2. Instead, report the gain from your “Business” worksheet on Form 4797. Space that was once used for business or rental purposes may be considered as residence space at the time of sale. A space formerly used for business is considered residence space if ALL of the following are true. You can’t deduct this loss, but you don’t need to pay any tax on the money you received from selling your home.

If you inherited your home from a decedent who died before or after 2010, your basis is the fair market value of the property on the date of the decedent's death . If an estate tax return was filed or required to be filed, the value of the property listed on the estate tax return is your basis. If a federal estate tax return didn’t have to be filed, your basis in the home is the same as its appraised value at the date of death, for purposes of state inheritance or transmission taxes. This means you may be able to meet the 2-year residence test even if, because of your service, you didn’t actually live in your home for at least the 2 years during the 5-year period ending on the date of sale. The tax code recognizes the importance of home ownership by allowing you to exclude gain when you sell your main home. To qualify for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly), you must meet the Eligibility Test, explained later.

She specializes in energy efficiency building practices and renewable energy. Dillon has been syndicated by the National Newspaper Publisher's Association. Her work has also appeared in the "Journal Of Progressive Human Services." This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

Report as ordinary income on Form 1040, 1040-SR, or 1040-NR any amounts received for sales of expired options to purchase your property. There is confusion around the new tax, because it will impact only additional properties you pay utilities on. But the tax does not apply to your primary residence. If you own one Kentucky home and live in it, you don't have to worry about the changes in residential utility sales taxes. William Perez is a tax expert with 20+ years of experience advising on individual and small business tax.

The more of these factors that are true of a home, the more likely that it is your main home. Generally, if you transferred your home to a spouse or ex-spouse as part of a divorce settlement, you are considered to have no gain or loss. You have nothing to report from the transfer and this entire publication doesn’t apply to you. If your spouse or ex-spouse is a nonresident alien, then you likely will have a gain or loss from the transfer and the tests in this publication apply.

No comments:

Post a Comment