Table of Content

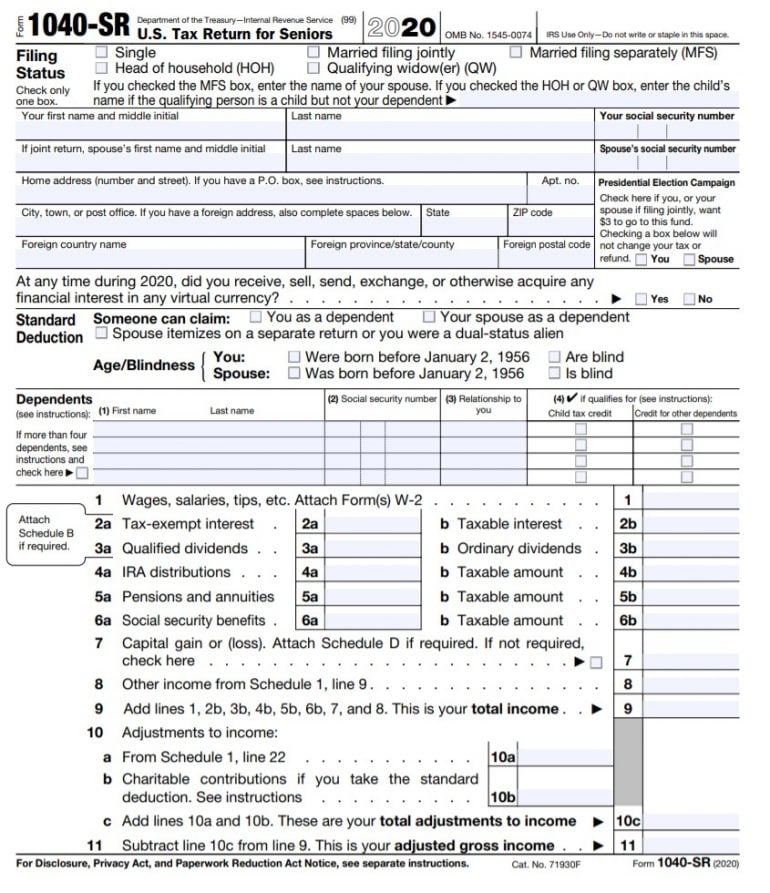

This includes requests for personal identification numbers , passwords, or similar information for credit cards, banks, or other financial accounts. If you received any homebuyer credits or federal mortgage subsidies, you may have to pay back (“recapture”) some or all of the amount by increasing your tax payment. If you have any taxable gain from the sale of your home, you may have to increase your withholding or make estimated tax payments. You have taxable gain on your home sale and don’t qualify to exclude all of the gain.

Get free, objective, performance-based recommendations for top real estate agents in your area. “I tell everybody to consult with their tax financial advisors because it depends on your estate planning needs, your age, where you’re at income-wise and investment-wise. It’s not really cut and dried,” says Chris Carter, who ranks in the top 2% of 2,633 agents in Jackson County, Missouri. There are some helpful things to keep in mind before you assume you can avoid paying taxes on your home sale.

Millions of Americans set to get surprise tax forms in 2023

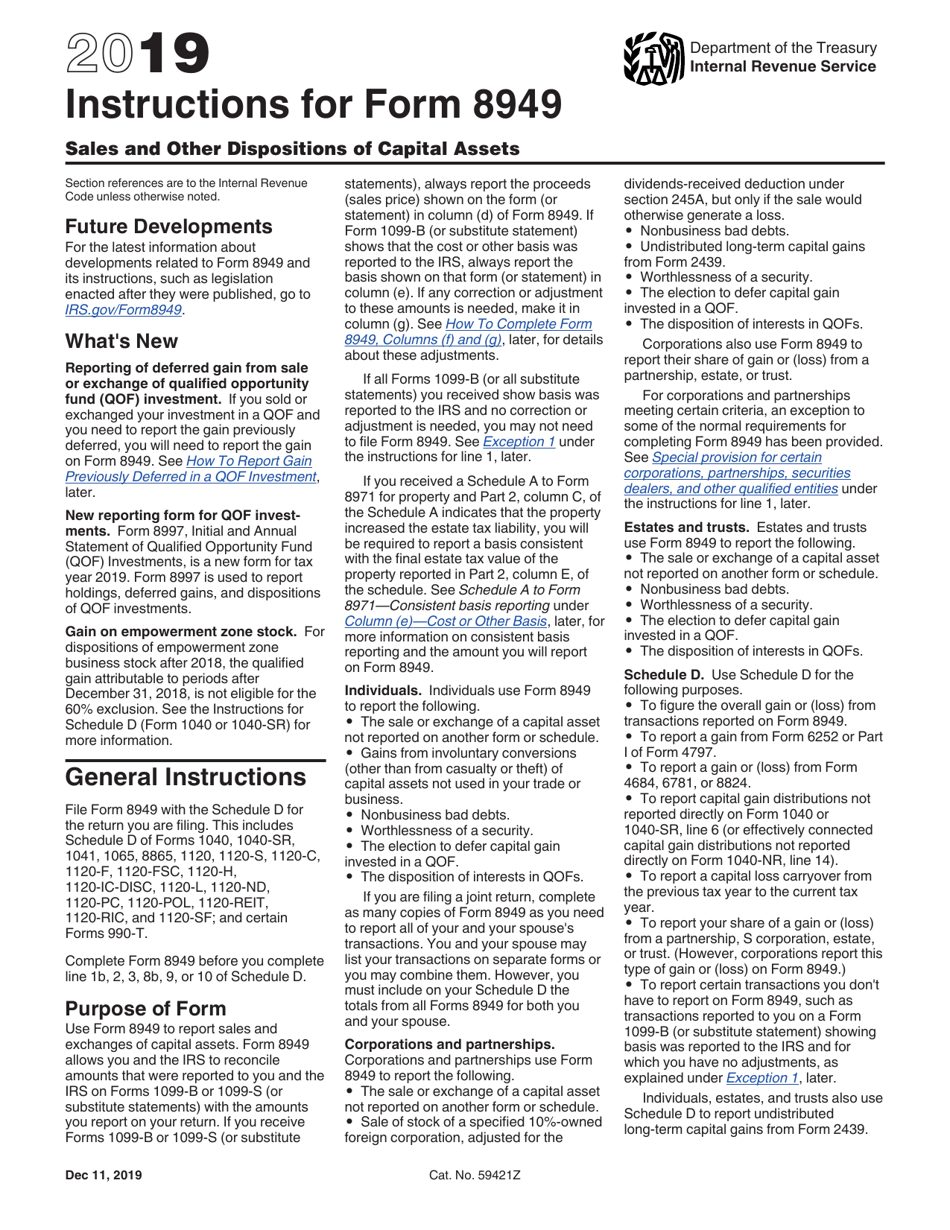

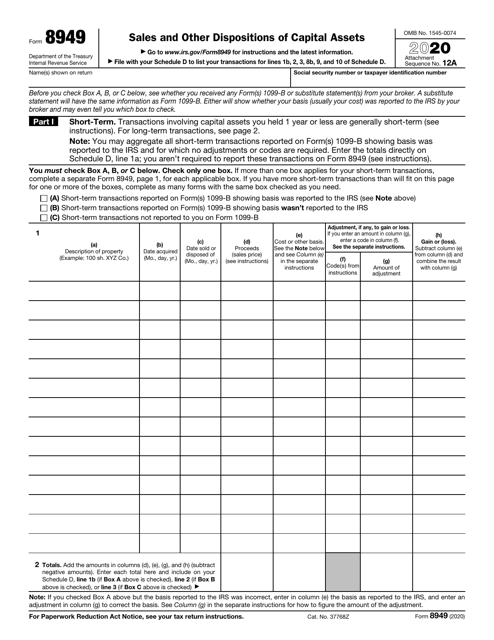

Report a corporation's share of capital gains and losses from investments in partnerships, estates, or trusts on the appropriate part of Form 8949. Report a net short-term capital gain on Part I and a net long-term capital gain on Part II . In column , enter “From Schedule K-1 ” or “From Schedule K-1 ,” whichever applies; enter the gain in column ; and leave all other columns blank. This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it.

Professional golfer taxes can be complicated and confusing. Learn more about tricky golfer tax issues like travel deductions and residency rules with H&R Block. However, you can’t exclude the part of the gain equal to any depreciation allowed or allowable after May 6, 1997. Periods of nonqualified use after Dec. 31, 2008, will also reduce the amount you can exclude. Change homes if a doctor recommends a change of residence. This could be due to an issue in getting or providing medical or personal care for the suffering person.

Do You Have To Pay US Taxes on the Sale of Foreign Property?

For example, if $75,000 was reported in column of Form 4797, report ($75,000) in column of Form 8949. Each QOF investment of IRC section 1231 gains will use two separate rows in Part I (short-term transactions) or Part II (long-term transactions), as applicable, of Form 8949. For compensatory options granted after 2013, the basis information reported to you on Form 1099-B won’t reflect any amount you included in income upon grant or exercise of the option. Increase your basis by any amount you included in income upon grant or exercise of the option.

Escrow agent refuses to correct the number of transferors with allocation changes on the substitute form 1099s when she was informed of mistake after escrow closing which prejudices my tax return by concealing information. As you navigate this process, be sure to consult a real estate tax attorney or accountant if you need help getting everything in order. For example, if the sale was for less than $600 , or if the transaction was closed without a title company or closing attorney and you agreed to be responsible for reporting the sale.

Is selling a house considered income?

The basis of inherited property is generally the fair market value at the date of death. If you inherited the property from someone who died in 2010 and the executor of the estate made the election to file Form 8939, also enter “INH-2010” in column . You can use stock ticker symbols or abbreviations to describe the property as long as they are based on the descriptions of the property as shown on Form 1099-B or 1099-S .

If you completed “Business” and “Home” versions of your gain/loss worksheet as described in Business or Rental Use of Home, earlier, complete this worksheet only for the “Home” version. For a step-by-step guide to determining whether your home sale qualifies for the maximum exclusion, see Does Your Home Sale Qualify for the Exclusion of Gain? If you have questions as you work through these step-by-step instructions, or want examples of costs that can and can’t be included, see Basis Adjustments—Details and Exceptions. If you or your spouse or ex-spouse lived in a community property state, see Pub.

“You’re going to need records in case you get audited,” he says. Either of the above is true for your spouse or home’s co-owner, if that person lived in the house. The PMI deduction was set to expire in 2020, but The Consolidated Appropriations Act effectively extends your ability to claim PMI tax deductions for the 2021 tax period. This fiscal year, the 1099-S form must be mailed to the recipient by February 15, 2018 and e-filed with the IRS by April 2, 2018. A 1099S form contains information about the Filer, the Transferor, the Date of Closing, Proceeds, and details of the property being transferred.

Under Business Use, enter the Number of nonqualified use days after December 31, 2008, if any. Nonqualified use typically includes any time the home wasn't used as a principal residence. Enrollment in, or completion of, the H&R Block Income Tax Course or Tax Knowledge Assessment is neither an offer nor a guarantee of employment. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Additional time commitments outside of class, including homework, will vary by student.

She has a master's in journalism from the University of Missouri, and a bachelor's in journalism and professional writing from The College of New Jersey . Under theSale of Homesection, check the box forSale of Home. Line balance must be paid down to zero by February 15 each year.

The sale of your home will be reported on Form 8949 and Schedule D. Requiring the closing agent to file a 1099-S acts as a safeguard and keeps the IRS informed of what’s going on. With that said, if the transaction does not fall within one of these categories and you’re facilitating the closing yourself, you will likely need to file Form 1099-S. If you close a transaction with a title company or attorney , then they will usually collect the necessary information and file Form 1099-S on your behalf. This is an official IRS tax form that requires a lot of personal information, including your full name and address. Report your reinvested dividends with your other dividends, if any, on Form 1040, U.S.

Pathward does not charge a fee for this service; please see your bank for details on its fees. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.

You can revoke your choice to suspend the 5-year period at any time. A separation or divorce occurred during the ownership of the home. You acquired the property through a like-kind exchange , during the past 5 years. Your home sale isn’t eligible for the exclusion if ANY of the following are true. Finally, the exclusion can apply to many different types of housing facilities. A single-family home, a condominium, a cooperative apartment, a mobile home, and a houseboat each may be a main home and therefore qualify for the exclusion.

Use your own records to determine whether your gain is short term or long term. The sale or exchange of a capital asset not reported on another form or schedule. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. When you have an IP PIN, it prevents someone else from filing a tax return with your SSN. The fastest way to receive a tax refund is to file electronically and choose direct deposit, which securely and electronically transfers your refund directly into your financial account. Direct deposit also avoids the possibility that your check could be lost, stolen, or returned undeliverable to the IRS.

During that period, Mary owned the house all 5 years and lived in it as her main home from August 2, 2007, until August 28, 2009, a period of more than 24 months. She meets the ownership and use tests because she owned and lived in the home for at least 2 years during this test period. Unfortunately, you can't claim a foreign tax credit based on any gains you excluded under the provisions of Internal Revenue Code Section 121—the $250,000 or $500,000 exclusions for the sale of your personal residence. The U.S. taxes you on any income you earn, whether it's earned in the U.S. or another country. So if you owned a home or property in another country, and then sold that home for a profit, you'll need to report the sale just as you would if it were located in the U.S. When you sell your home or when you are considered to have sold it, usually you do not have to pay tax on any gain from the sale because of the principal residence exemption.

No comments:

Post a Comment